On the other hand, if you overreport your deductions, you will end up with a smaller take-home amount in your paycheck, but a larger tax refund at the end of the year which is like giving the IRS a free loan. Proper calculation of the number of deductions is extremely important to avoid surprises during the tax season as you may end up owing money to the IRS.

Misspelling your name or SSN in the W-4 form will most likely result in your employer rejecting it so make sure the information is entered correctly. That is why we have prepared a list of common mistakes to avoid while you are filling out your Form W-4. Many have found this out the hard way - even a small typo in any of the Name fields could cost you big. However, mistakes on your tax forms can prove to be costly. The IRS has a website with extensive information about Form W-4 ( irs.gov/w4), including a FAQ and a link to the calculator.Mistakes are something we all make. They should write EXEMPT or NRA in space below Step 4(c) on the Form W-4.

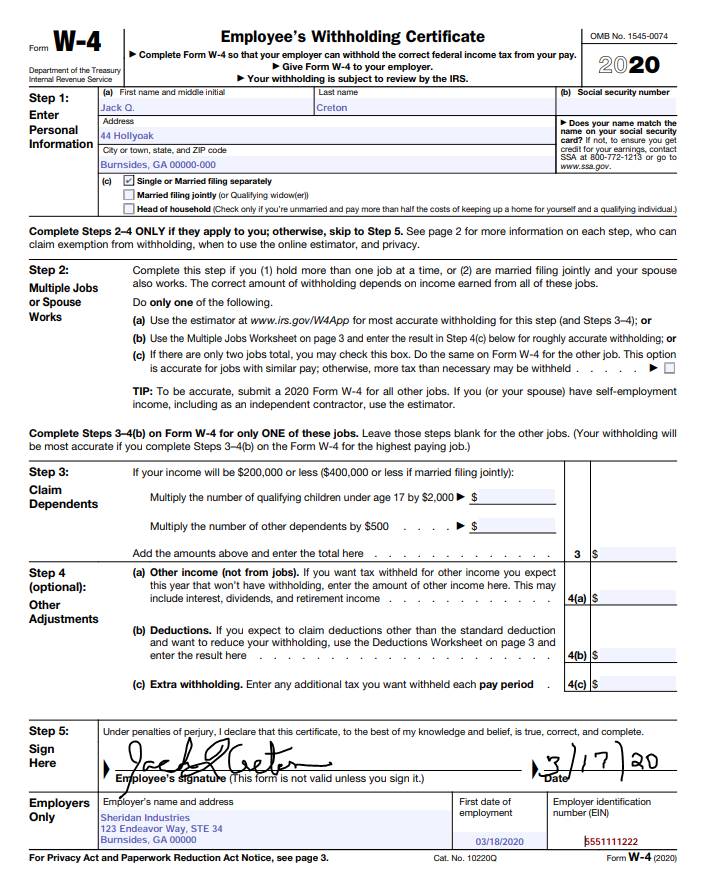

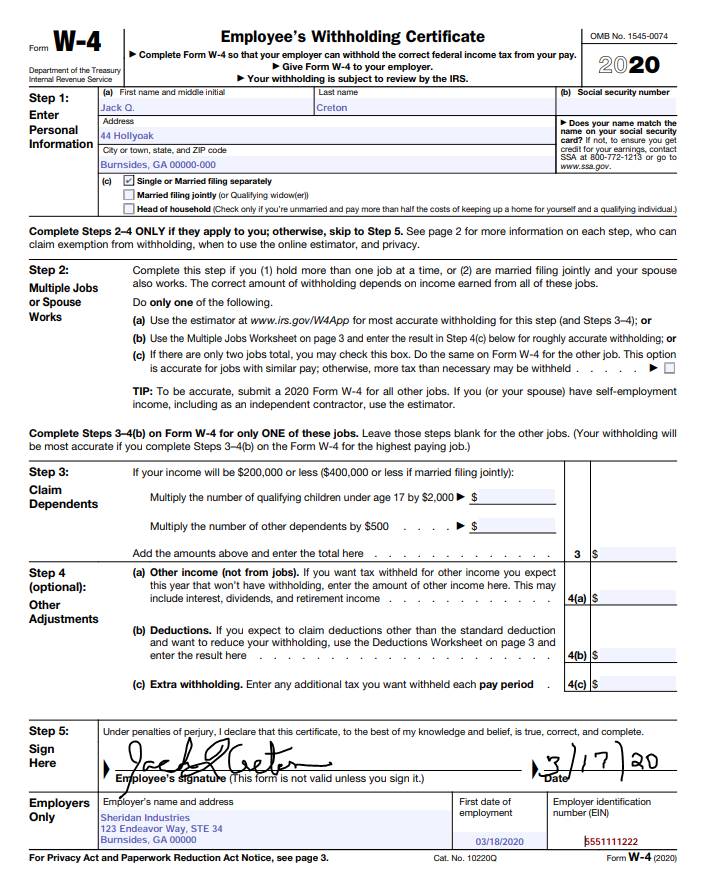

Current Students and Non-Resident Aliens who claimed EXEMPT from Withholding must file a new 2020 Form W-4 if they expect to have zero Federal Tax obligation.  New hires and current employees who require changes to withholding must complete the new 2020 Form W-4. Current employees may keep their existing W-4 in place if withholdings have been appropriate for the 2019 Federal tax year. What do I need to know as a university employee? To determine the additional withholding amount, you can use the withholding estimator. The IRS takes your privacy seriously and suggests that, if you are worried about reporting income from multiple jobs in Step 2 or other income in Step 4(a), you check the box in Step 2(c) or enter an additional withholding amount in Step 4(c). Step 1 is for your personal information Step 2 is for households with multiple jobs Step 3 is used to claim tax credits for dependents Step 4 is for other adjustments (additional income such as interest and dividends, itemized deductions that exceed the standard deduction, and extra tax you want withheld) and Step 5 is where you sign the form. Steps 2, 3, and 4 are optional, but completing them will help ensure that your federal income tax withholding will more accurately match your tax liability. PLEASE NOTE: if you do not submit a new form, withholding will continue based on your previously submitted form.īefore completing the 2020 Form W-4, please read the instructions that are included with the form. It is likely that the estimator will be updated to account for the 2020 tax tables in early January. To conduct the checkup, you can use the IRS Tax Withholding Estimator ( To effectively use the estimator, it is helpful to have a copy of your most recent pay stub and tax return. However, certain employees will be required to use the new form: those hired in 2020 and anyone who makes withholding changes during 2020.Įven though the IRS does not require all employees to complete the revised form and even if your tax situation has not changed, we recommend you perform a “paycheck checkup” to see if you need to make adjustments to your current withholding. The Internal Revenue Service (IRS) is not requiring all employees to complete the revised form and has designed the withholding tables so that they will work with both the new and prior year forms. This is due to the federal tax law changes that took place in 2018. The 2020 Form W-4, Employee's Withholding Certificate, is very different from previous versions. IRS Form W-4 has changed for tax year 2020.

New hires and current employees who require changes to withholding must complete the new 2020 Form W-4. Current employees may keep their existing W-4 in place if withholdings have been appropriate for the 2019 Federal tax year. What do I need to know as a university employee? To determine the additional withholding amount, you can use the withholding estimator. The IRS takes your privacy seriously and suggests that, if you are worried about reporting income from multiple jobs in Step 2 or other income in Step 4(a), you check the box in Step 2(c) or enter an additional withholding amount in Step 4(c). Step 1 is for your personal information Step 2 is for households with multiple jobs Step 3 is used to claim tax credits for dependents Step 4 is for other adjustments (additional income such as interest and dividends, itemized deductions that exceed the standard deduction, and extra tax you want withheld) and Step 5 is where you sign the form. Steps 2, 3, and 4 are optional, but completing them will help ensure that your federal income tax withholding will more accurately match your tax liability. PLEASE NOTE: if you do not submit a new form, withholding will continue based on your previously submitted form.īefore completing the 2020 Form W-4, please read the instructions that are included with the form. It is likely that the estimator will be updated to account for the 2020 tax tables in early January. To conduct the checkup, you can use the IRS Tax Withholding Estimator ( To effectively use the estimator, it is helpful to have a copy of your most recent pay stub and tax return. However, certain employees will be required to use the new form: those hired in 2020 and anyone who makes withholding changes during 2020.Įven though the IRS does not require all employees to complete the revised form and even if your tax situation has not changed, we recommend you perform a “paycheck checkup” to see if you need to make adjustments to your current withholding. The Internal Revenue Service (IRS) is not requiring all employees to complete the revised form and has designed the withholding tables so that they will work with both the new and prior year forms. This is due to the federal tax law changes that took place in 2018. The 2020 Form W-4, Employee's Withholding Certificate, is very different from previous versions. IRS Form W-4 has changed for tax year 2020.

0 kommentar(er)

0 kommentar(er)